By: Maadhav Poddar, Associate Director-Tax &

Regulatory services, Ernst & Young

Budget 2013, while did bring forward certain proposals

which are welcomed by the real

estate sector, but failed to

delight and bring cheers to this sector as it did not to cater to sector's long

standing demands and needs.

On direct tax front, while the proposal to provide additional interest deduction of Rs 1 lakhs for low cost housing (where loan taken is less than Rs 25 lakhs for a house valued at Rs 40 lakhs or less) is indeed welcome, the proposal to withhold taxes on transfer of immovable property above the threshold limit may add burden and worry to this sector.

From start of June 2013, taxes at the rate of 1% would be required to be deducted ( TDS) by every purchaser of an immovable property, other than agricultural land, while crediting or making payment to a resident seller, if the consideration for such immovable property exceeds Rs 50 lakhs. This requirement may lead to additional withholding compliance burden on purchasers and would negatively impact the working capital requirements of sellers/ developers.

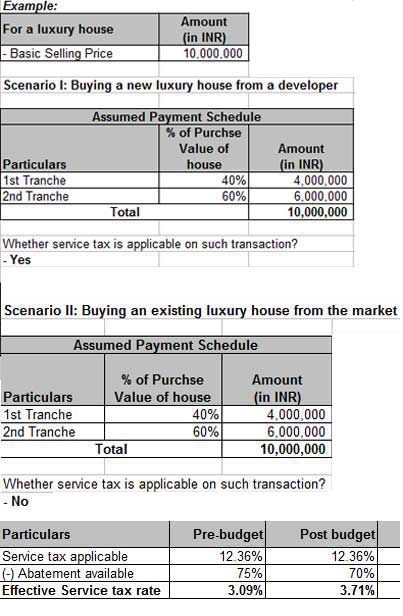

On the indirect tax front, post 1st March 2013, purchase of luxury houses will become dearer. The reduction in service-tax abatement rate from 75% to 70% would increase the effectiveservice tax rate from 3.09% to 3.71% on pre-construction sale of residential units having carpet area of more than 2000 sq ft and where the amount charged for the unit is Rs 1 crore or above. This would lead to increase in the overall cost which would borne by the buyers. However, it is to be noted that service tax continues not to apply on transactions involving buying-selling of constructed houses/ property as there is no service element involved in such transactions.

To illustrate the impact of the above two proposals, let's consider the following example. Mr. A plans to buy either an existing house or an unit in the upcoming residential housing project in New Delhi after 1st June 2013 for a consideration of Rs 1 crore which has a carpet area of more than 2000 sq ft (approx. 222 sq yards). The impact of the direct and in-direct proposal discussed above shall be as follows:

On direct tax front, while the proposal to provide additional interest deduction of Rs 1 lakhs for low cost housing (where loan taken is less than Rs 25 lakhs for a house valued at Rs 40 lakhs or less) is indeed welcome, the proposal to withhold taxes on transfer of immovable property above the threshold limit may add burden and worry to this sector.

From start of June 2013, taxes at the rate of 1% would be required to be deducted ( TDS) by every purchaser of an immovable property, other than agricultural land, while crediting or making payment to a resident seller, if the consideration for such immovable property exceeds Rs 50 lakhs. This requirement may lead to additional withholding compliance burden on purchasers and would negatively impact the working capital requirements of sellers/ developers.

On the indirect tax front, post 1st March 2013, purchase of luxury houses will become dearer. The reduction in service-tax abatement rate from 75% to 70% would increase the effectiveservice tax rate from 3.09% to 3.71% on pre-construction sale of residential units having carpet area of more than 2000 sq ft and where the amount charged for the unit is Rs 1 crore or above. This would lead to increase in the overall cost which would borne by the buyers. However, it is to be noted that service tax continues not to apply on transactions involving buying-selling of constructed houses/ property as there is no service element involved in such transactions.

To illustrate the impact of the above two proposals, let's consider the following example. Mr. A plans to buy either an existing house or an unit in the upcoming residential housing project in New Delhi after 1st June 2013 for a consideration of Rs 1 crore which has a carpet area of more than 2000 sq ft (approx. 222 sq yards). The impact of the direct and in-direct proposal discussed above shall be as follows:

Where a housing unit is booked in a project under

construction from a developer, Mr. A will have to bear the additional service

tax burden of Rs 61,800, due to the 20% hike in the effective service tax rate

from 3.09% to 3.71%. This is because the developer would charge service tax as

per the revised rates from the buyer and deposit the same before the 5th of

every next month to the government treasury account while taking care of other

service tax compliances.

Also, Mr. A would be required to deduct TDS@ 1%

each time while making part-payment to the developer. Accordingly, Mr. A would

also have to obtain a Tax Deduction

Account Number ( TAN), deposit TDS

before 7th of every next month and file quarterly TDS returns, failing which

could attract interest and even penalty consequences on him. It is to be noted

that taxes would be required to be deducted by Mr. A on the all advance payments

(inclusive of service taxcomponent) at the time of making such payment or making a credit entry

for the same in his books, whichever is earlier.

Where Mr. A decides to buy a completed house from the market, service tax shall not be

applicable. However, Mr. A would still be required to comply with withholding

tax compliances as explained above as the transaction value of the property is above Rs 50 lakhs.

Further, on a one crore house transaction in New Delhi, Mr. A would also have to dish out an additional amount of about Rs 7 lakhs as stamp duty and registration fee. Where, Mr. A decides to register the house in the name of his wife/ daughters, stamp duty and registration fee burden may reduce to about Rs 5 lakhs as Delhi stamp duty law levies lower stamp duty on women. Thankfully, such amount of stamp duty and registration fee still continues to be not subject to any TDS or service tax.

Further, on a one crore house transaction in New Delhi, Mr. A would also have to dish out an additional amount of about Rs 7 lakhs as stamp duty and registration fee. Where, Mr. A decides to register the house in the name of his wife/ daughters, stamp duty and registration fee burden may reduce to about Rs 5 lakhs as Delhi stamp duty law levies lower stamp duty on women. Thankfully, such amount of stamp duty and registration fee still continues to be not subject to any TDS or service tax.

Hi,

ReplyDeleteThis article indicates that the TDS is not applicable on flat registration charges.

I need to find out whether TDS is not applicable on maintenance deposit ( corpus deposit) as well. My builder says that since that is a deposit which would be handed over maintained by society later, TDS won't be applicable on the same. Is the builder correct? I have to pay this maintenance upfront to builder as I have availed 80:20 scheme.

Best regards,

This comment has been removed by the author.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteNice post!!! For you information, Hyderabad is an evergreen place in the real estate market. And a place where you can buy properties in hyderabad for sale in an affordable range.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThis comment has been removed by the author.

ReplyDelete